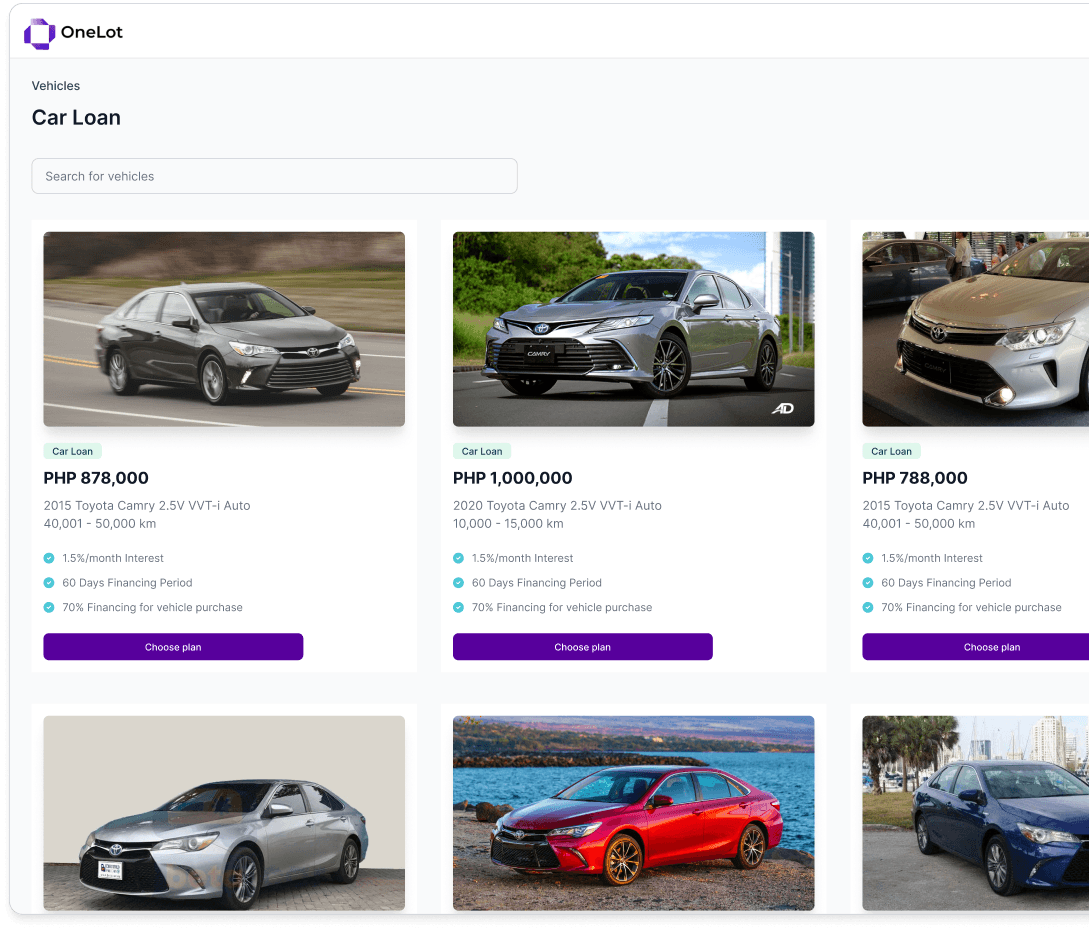

Dealer Inventory Loans

Discover how OneLot's comprehensive car financing solutions can propel your dealership to new heights. OneLot’s dealer inventory loans are flexible and individually tailored for each car purchasing opportunity you have, enabling dealerships to grow their business effectively.

Regulated by

Key Facts About OneLot Dealer Inventory Loans

OneLot’s dealer loans are designed to be as flexible as a dealer’s day-to-day operations. The loan amount is determined by the value of the car, and once the vehicle is sold, the loan can be repaid seamlessly.

1.75%

Interest per month, calculated daily

70%

Financing of car value

90 days

Financing period with flexible repayment or refinancing options

Process to get a loan

Step 1

Effortless Onboarding

OneLot onboarding is easy and straight forward onboarding process. We only require a few documents and after a few days you can get your first loan.

Step 2

Simplified Loan Applications

Once onboarding is complete, applying for individual car loans becomes a breeze. Just upload the details of the car and documents and we come back to you within minutes with a first credit indication. Afterwards we schedule an inspection and provide you with the final loan amount and conditions.

Step 3

Quick Access to Funds

When your loan application is approved, OneLot swiftly transfers the funds needed to acquire new cars and grow your inventory. Our efficient disbursement process allows money to be on your account instantly and ensures you can seize opportunities and stay ahead in a competitive market.

Requirements

For Dealers

Business Details (Name, Address, TIN/DTI Certificate)

Personal Details

Bank Statement (last 3 months) (OPTIONAL)

For Cars

Ideally Japanese or Korean manufactured

OR/CR and deed of sale available

Car has no current liens, alerts or encumbrances

Get Started Today

We look forward to serving the needs of used car dealers across the Philippines and helping them thrive in this dynamic market.

Get Started